property tax in nice france

No matter if you own or rent the place as a. Any person living abroad and owner of real estate in France is subject to French property tax.

French Property Tax Hikes Scheduled For 2022

If your property income from furnished rentals is less than 70000 in revenue per year you may benefit from the micro regime.

. The land or property tax In France once an individual or a household becomes the owner of a property whether built or not they also become liable for the land or property tax. Here is how it is calculated. There is a 75 exemption on the value of woodland.

Taxe foncière paid by the owners of property regardless of whether they live there and taxe dhabitation paid by the property. Any owner of real estate in france on 1 st january of the taxation year must pay the property tax during the. In french its known as droit de mutation.

There are 2 types of property taxes in France the taxe dhabition and the taxe foncière. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. The French taxe foncière is an annual property ownership tax which is payable in October every year.

Total the owner will have to pay an annual property tax of 179275 euros 6265 621 1025 475 60. Buying property in France you pay. You are liable for this tax if the net value of your property in France exceeds 1300000 euros.

French property tax for dummies. Property Tax In Nice France. Taxe foncière property tax payable by all owners in France is deductible from the value of the relevant property.

A homebuyer can expect to pay about 7 of the purchase price of an existing property in taxes and fees such as stamp duty notary fees and transfer taxes he said. They include agents fees 5-8 notary fees 25-5 stamp duty 58 and registration cost 1-3. France levies two types of property taxes.

That is to say that you declare everything you have received. Property Tax in France Land TaxTaxe foncière. - pro rata land tax the seller pays this annual tax but you repay the notary.

There is no exemption. There are also transfer taxes due when a home is purchased she said. The property located in the prestigious neighbourhoods has a higher.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. - registration fees also called the notary fees around 75 of the purchase price. It is payable by the individual who owns.

The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households. These include a departmental tax usually 45 of the purchase price as well as a communal tax at. For properties more than 5 years old stamp.

So the difference between the price you bought it for and the price. In France there are two property taxes to pay Taxe dHabitation and Taxe Foncière both are forms of a council tax. The Taxe Foncière is payable by property owners whether they live in.

The tax rate varies between 050 and 150 of the declared value of the. This tax known as impôt sur les plus values in France is payable on the profits of selling a property or land. Anyone who lives in France pays the tax dhabitation.

The total taxes paid during the house purchase in France may add up 20 to the property price.

The Tax Implications Of Owning A French Property Complete France

Capital Gains Tax On Property In France Nice French Riviera Cm Tax

Property Tax Assistant Average Salary In France 2022 The Complete Guide

French Tax Collectors Use A I To Spot Thousands Of Undeclared Pools The New York Times

Property Tax Has Increased On Average By 20 In 2015 For 120 French Cities Rahma Sophia Rachdi United States Press Agency News Uspa News

Buying Property In France A Practical Guide To The French Wealth Tax Perfectly Provence

Real Estate Taxes In France Star Leman Immobilier Lake Geneva Properties

French Property Tax For Non Residents Ptireturns Com Blog

French Property Tax Hikes Scheduled For 2022

Property Occupation Tax In France Increased Paris Property Group

Understanding French Property Tax

Are Property Taxes Going Up In France Mansion Global

What Are The Property Taxes On A 2 Million Vacation Home In Bordeaux Mansion Global

French Property Tax Explained Property For Sale In France Cle France The French Property Network

Franchot Urges Counties City To Reduce Local Property Taxes Maryland Daily Record

What Are Property Taxes Like In The South Of France Mansion Global

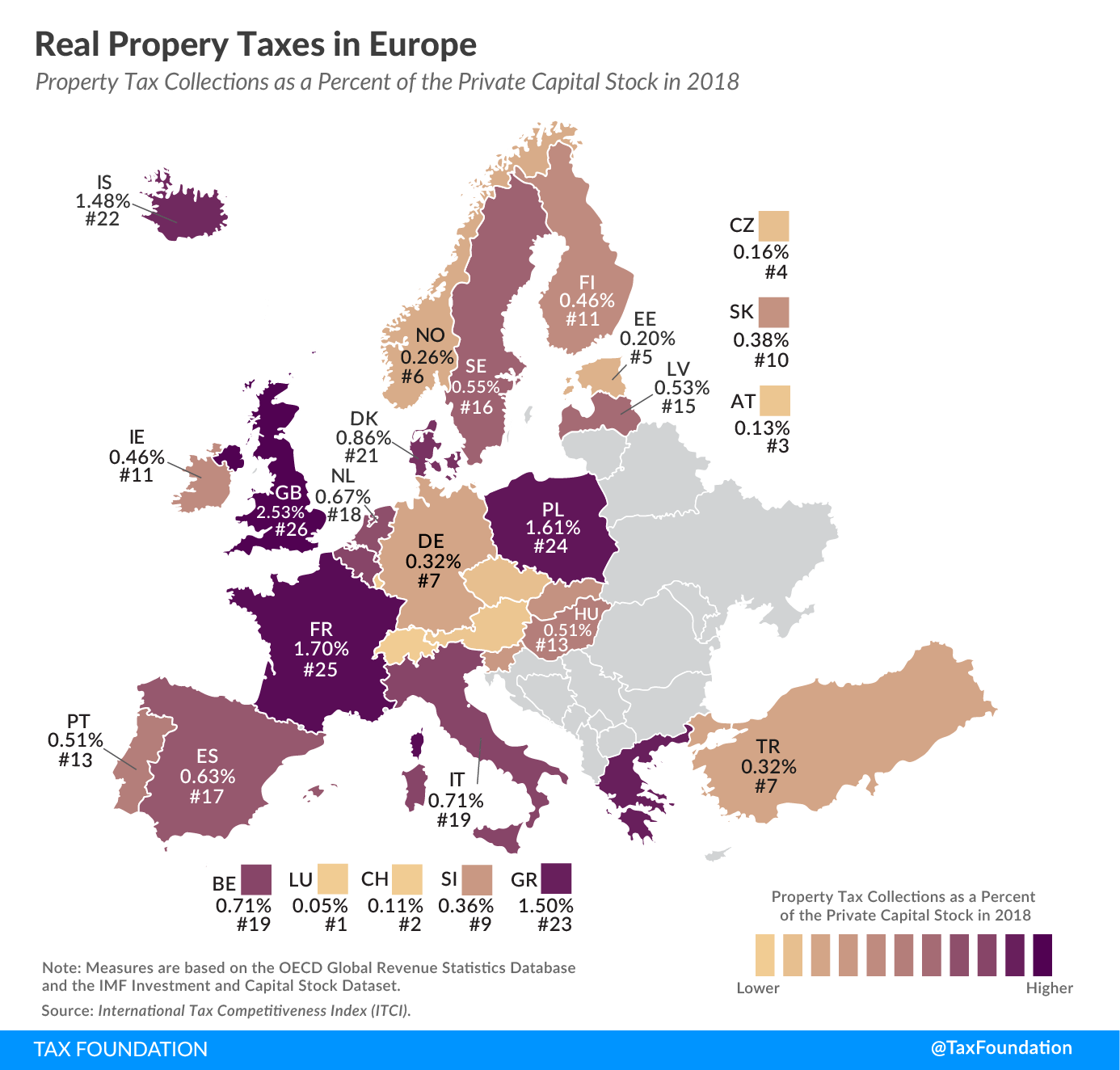

Real Property Taxes In Europe European Property Tax Rankings