are raffle tickets tax deductible if you don't win

The IRS explicitly prohibits deducting the cost of raffle tickets as a charitable contribution presumably because it does not consider the cost of the ticket to be greater than its benefit. Thats because you are not actually making.

11 Organ Donor Card Template Note Card Template Card Templates Free Card Template

If youre lucky enough to.

. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Please remember even if you dont win this raffle item. Are raffle tickets tax deductible if you dont win Friday February 11 2022 Edit.

If you dont win are raffle tickets tax deductible. Is it possible that tickets are. For example if you bought 100 worth of raffle tickets.

Ask your local tax professional if you have any questions. Unfortunately purchasing a raffle ticket to benefit a non-profit organization is not a tax-deductible expense. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable. An organization that pays raffle prizes must withhold 25 from the winnings and report this amount to the irs on form w. Are Raffle Tickets Tax Deductible If You Dont Win.

Thats because you are not actually making. Winners are encouraged to consult a tax professional. Are raffle tickets tax deductible if you dont win.

Are raffle tickets tax deductible if you dont win. Are Raffle Tickets Tax Deductible The Finances Hub Are Nonprofit Raffle Ticket Donations. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

Are Raffle Tickets Tax Deductible If You Dont Win. Are raffle tickets tax deductible if you dont win. Thats because you are not actually making.

An organization that pays raffle prizes must withhold 25 from the winnings and report this amount to the IRS on Form W-2G. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Are raffle tickets tax deductible if you dont win.

Thats because you are. Thats because you are not actually making. Are raffle tickets tax deductible if you dont win.

Are Raffle Tickets Tax Deductible The Finances Hub

35 Quotes That Will Help Set Your Weeks Intentions Because Im Addicted Work Quotes Boss Quotes Inspirational Words

Raffles As An Irs Donation Deduction

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

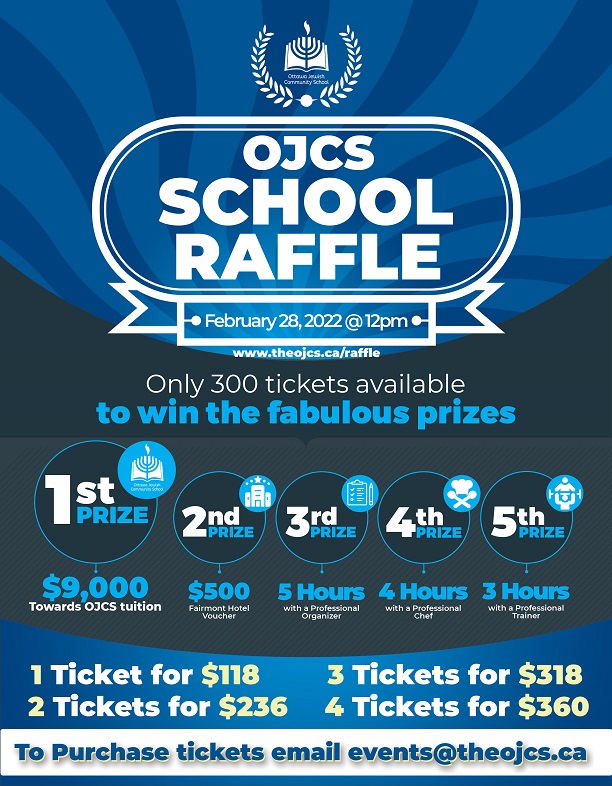

Get Your Tickets For The Ojcs School Raffle The Ottawa Jewish Community School

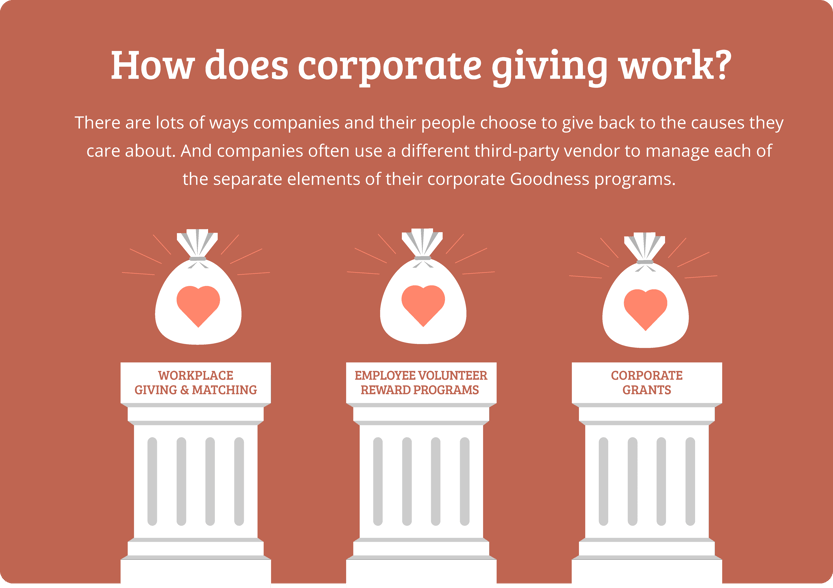

Do 100 Of Donations Really Go To The Charity

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Weirdest Things Canadians Have Tried To Claim On Their Taxes H R Block Canada

Is Mittens Yawning Or Is Mittens Meowing What S Your Guess You Can Follow House Of Dreams Everywh Katzen

11 Organ Donor Card Template Note Card Template Card Templates Free Card Template

Are Nonprofit Raffle Ticket Donations Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Weirdest Things Canadians Have Tried To Claim On Their Taxes H R Block Canada

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball